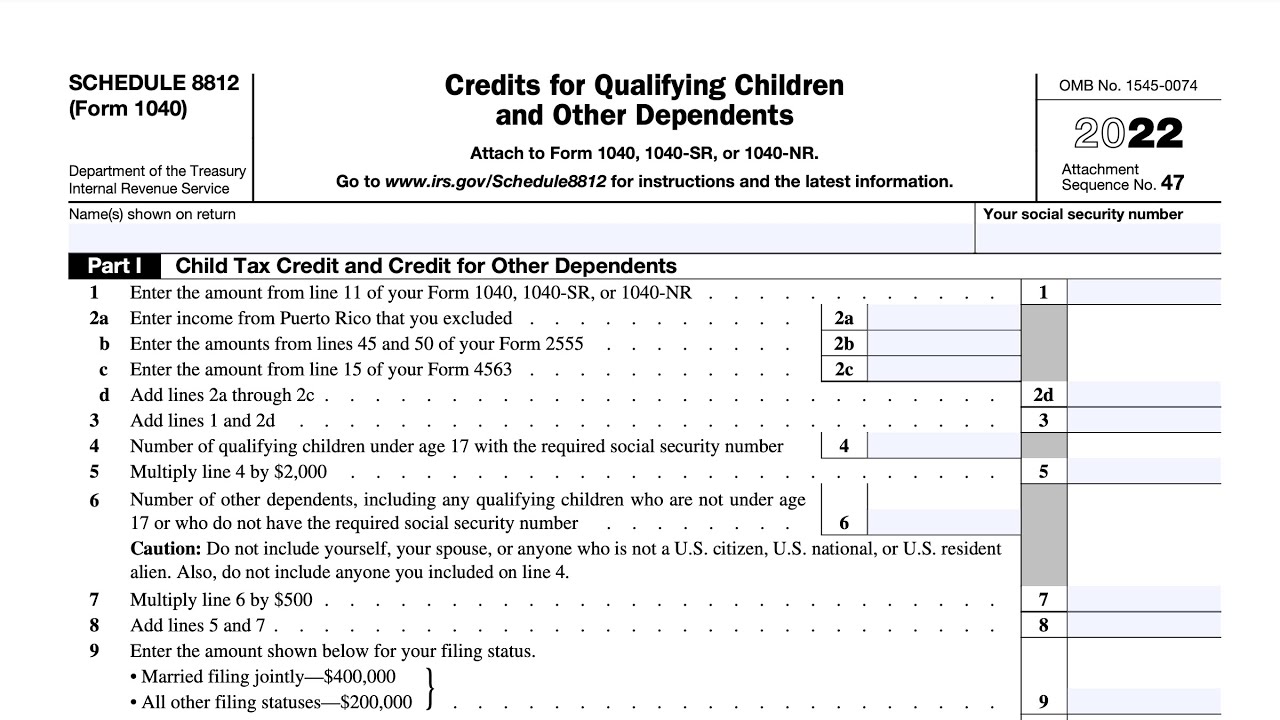

8812 Credit Limit Worksheet A - There are several worksheets you might need to complete as you go through irs schedule 8812: Otherwise, enter the amount from the credit. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. It shows how to enter the amounts from your tax return and other. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. Line 4 of schedule 8812 is more than zero.. For all returns except tax. This is a pdf form for calculating your credit limit for certain tax credits.

It shows how to enter the amounts from your tax return and other. Line 4 of schedule 8812 is more than zero.. Otherwise, enter the amount from the credit. There are several worksheets you might need to complete as you go through irs schedule 8812: The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. This is a pdf form for calculating your credit limit for certain tax credits. For all returns except tax.

Line 4 of schedule 8812 is more than zero.. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. There are several worksheets you might need to complete as you go through irs schedule 8812: This is a pdf form for calculating your credit limit for certain tax credits. Otherwise, enter the amount from the credit. For all returns except tax. It shows how to enter the amounts from your tax return and other. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21.

2022 Schedule 8812 Credit Limit Worksheet A

Otherwise, enter the amount from the credit. It shows how to enter the amounts from your tax return and other. This is a pdf form for calculating your credit limit for certain tax credits. There are several worksheets you might need to complete as you go through irs schedule 8812: The schedule 8812 credit limit worksheet a is an important.

Form 8812 Credit Limit Worksheet A 2022

Otherwise, enter the amount from the credit. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. It shows how to enter the amounts.

Schedule 8812 Credit Limit Worksheet A

For all returns except tax. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Otherwise, enter the amount from the credit. It shows.

Irs Form 8812 Credit Limit Worksheet A

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. This is a pdf form for calculating your credit limit for certain tax credits. Otherwise, enter the amount from the credit. There are several worksheets you might need to complete as you go.

8812 Credit Limit Worksheet A 2023

There are several worksheets you might need to complete as you go through irs schedule 8812: This is a pdf form for calculating your credit limit for certain tax credits. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. It shows how.

Schedule 8812 Instructions Credits for Qualifying Dependents

Line 4 of schedule 8812 is more than zero.. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter.

2023 Schedule 8812 Credit Limit Worksheet A

For all returns except tax. This is a pdf form for calculating your credit limit for certain tax credits. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. It shows how to enter the amounts from your tax return and other. Line.

Schedule 8812 Line 5 Worksheet 2021

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. It shows how to enter the amounts from your tax return and other. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. This.

Line 5 Worksheets Schedule 8812

It shows how to enter the amounts from your tax return and other. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. Line 4 of schedule 8812 is more than zero.. Review the child tax credit and credit for other dependents worksheet.

Form 8812 Credit Limit Worksheet A Printable Calendars AT A GLANCE

Otherwise, enter the amount from the credit. For all returns except tax. There are several worksheets you might need to complete as you go through irs schedule 8812: It shows how to enter the amounts from your tax return and other. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when.

Review The Child Tax Credit And Credit For Other Dependents Worksheet To See Whether They Qualify For The Credit.

There are several worksheets you might need to complete as you go through irs schedule 8812: The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Otherwise, enter the amount from the credit.

For All Returns Except Tax.

It shows how to enter the amounts from your tax return and other. Line 4 of schedule 8812 is more than zero.. This is a pdf form for calculating your credit limit for certain tax credits.