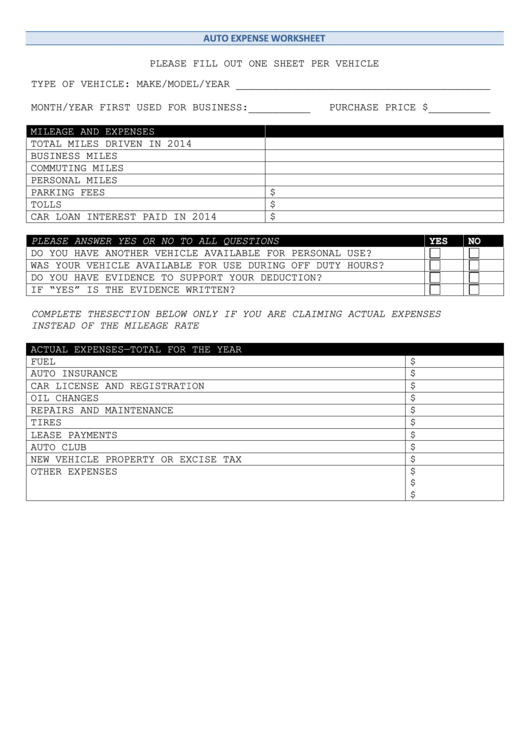

Auto Expense Worksheet - License plate taxes (car tabs) paid. To claim actual expenses and depreciation or lease payments, we need the following info: Fill out below only if claiming actual expenses. Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. If you want to use the “easy” but. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Car and truck expenses for business purposes are deductible expenses. All business mileage and expenses should be. Cost of your vehicle (please provide invoice).

If you want to use the “easy” but. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Fill out below only if claiming actual expenses. Car and truck expenses for business purposes are deductible expenses. All business mileage and expenses should be. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. License plate taxes (car tabs) paid. To claim actual expenses and depreciation or lease payments, we need the following info:

License plate taxes (car tabs) paid. If you want to use the “easy” but. Fill out below only if claiming actual expenses. All business mileage and expenses should be. Car and truck expenses for business purposes are deductible expenses. To claim actual expenses and depreciation or lease payments, we need the following info: Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction.

Vehicle Expense Tracker Manage Your Car Expenses Easily

License plate taxes (car tabs) paid. Fill out below only if claiming actual expenses. Car and truck expenses for business purposes are deductible expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. To claim actual expenses and depreciation or lease payments, we need the following info:

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

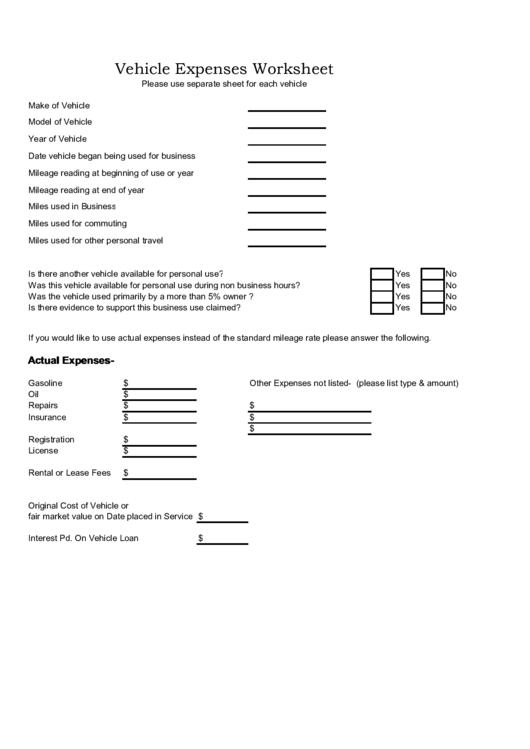

To claim actual expenses and depreciation or lease payments, we need the following info: If you want to use the “easy” but. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Fill out below only if claiming actual expenses.

Tax Expenses Worksheet For Vehicle Expenses

Car and truck expenses for business purposes are deductible expenses. To claim actual expenses and depreciation or lease payments, we need the following info: All business mileage and expenses should be. Fill out below only if claiming actual expenses. If you want to use the “easy” but.

Auto Expense Worksheet printable pdf download

License plate taxes (car tabs) paid. To claim actual expenses and depreciation or lease payments, we need the following info: All business mileage and expenses should be. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Please complete this worksheet so that we can calculate the correct.

Auto Expense Worksheet Printable Word Searches

License plate taxes (car tabs) paid. Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Cost of your vehicle (please provide invoice). Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. All business mileage and expenses should be.

Vehicle Expense Worksheet

To claim actual expenses and depreciation or lease payments, we need the following info: Fill out below only if claiming actual expenses. Car and truck expenses for business purposes are deductible expenses. All business mileage and expenses should be. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle.

Vehicle Expenses Worksheet printable pdf download

If you want to use the “easy” but. Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. License plate taxes (car tabs) paid. Car and truck expenses for business purposes are deductible expenses. Fill out below only if claiming actual expenses.

Vehicle Expense Tracker Manage Your Car Expenses Easily Worksheets

To claim actual expenses and depreciation or lease payments, we need the following info: License plate taxes (car tabs) paid. Fill out below only if claiming actual expenses. Car and truck expenses for business purposes are deductible expenses. Cost of your vehicle (please provide invoice).

13 Free Sample Auto Expense Report Templates Printable Samples

To claim actual expenses and depreciation or lease payments, we need the following info: License plate taxes (car tabs) paid. Fill out below only if claiming actual expenses. Cost of your vehicle (please provide invoice). Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date.

Car and Truck Expenses Worksheet 4 Free Worksheets Worksheets Library

To claim actual expenses and depreciation or lease payments, we need the following info: If you want to use the “easy” but. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Fill out below only if claiming actual expenses.

If You Want To Use The “Easy” But.

Car and truck expenses for business purposes are deductible expenses. License plate taxes (car tabs) paid. Cost of your vehicle (please provide invoice). To claim actual expenses and depreciation or lease payments, we need the following info:

Please Complete This Worksheet So That We Can Calculate The Correct Amount Of Your Auto Expense Deduction.

Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Fill out below only if claiming actual expenses. All business mileage and expenses should be.