California Earned Income Tax Credit Worksheet Part Iii Line 6 - Claiming your eitc is easy. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. You must fill out your child/children's qualifying information along with your earned income to obtain the. Tax form for earned income tax credits. Just file your state and/ or federal tax returns. Be sure to check both state and federal eligibility requirements. If the amount is zero or less, stop here. Complete the california earned income tax credit worksheet below. Enter your california earned income from form ftb 3514, line 19. Look up the amount on line.

If the amount is zero or less, stop here. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Complete the california earned income tax credit worksheet below. Tax form for earned income tax credits. Claiming your eitc is easy. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Just file your state and/ or federal tax returns. Look up the amount on line. Enter your california earned income from form ftb 3514, line 19. Enter your california earned income from form ftb 3514, line 19.

Be sure to check both state and federal eligibility requirements. Complete the california earned income tax credit worksheet below. You must fill out your child/children's qualifying information along with your earned income to obtain the. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Enter your california earned income from form ftb 3514, line 19. Claiming your eitc is easy. Enter your california earned income from form ftb 3514, line 19. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Just file your state and/ or federal tax returns. Look up the amount on line.

Ca Earned Tax Credit Worksheet 2020

Enter your california earned income from form ftb 3514, line 19. Complete the california earned income tax credit worksheet below. Just file your state and/ or federal tax returns. Look up the amount on line. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6.

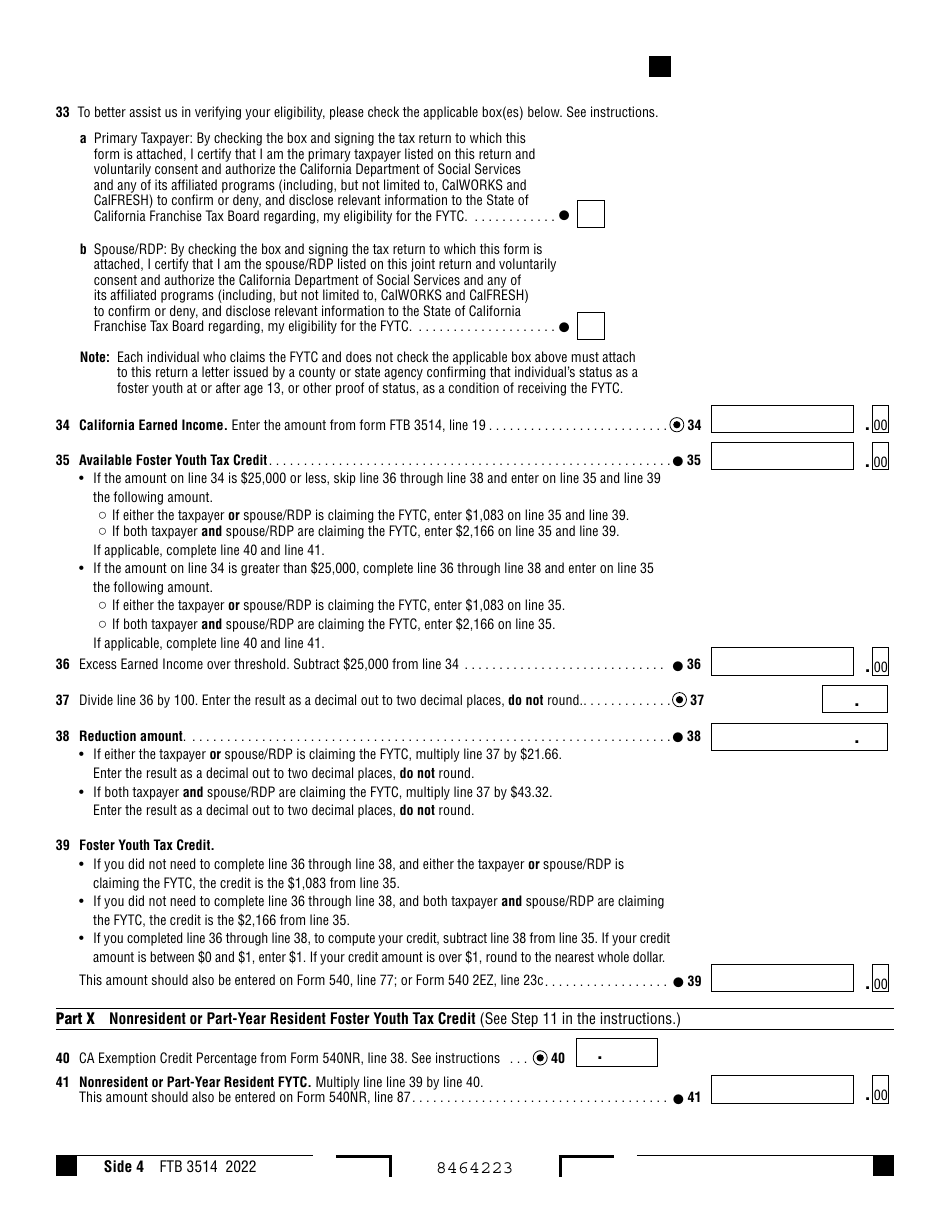

Ca Earned Tax Credit Worksheet 2022

Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Claiming your eitc is easy. Complete the california earned income tax credit worksheet below. Look up the amount on line. Enter your california earned income from form ftb 3514, line 19.

California Earned Tax Credit Worksheet Printable Calendars AT

If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Look up the amount on line. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Enter your california earned income from form ftb 3514, line 19. Claiming your eitc is easy.

California Earned Tax Credit Worksheet

Enter your california earned income from form ftb 3514, line 19. Just file your state and/ or federal tax returns. Enter your california earned income from form ftb 3514, line 19. You must fill out your child/children's qualifying information along with your earned income to obtain the. Be sure to check both state and federal eligibility requirements.

California Earned Tax Credit Worksheet 2015 Worksheet Resume

Enter your california earned income from form ftb 3514, line 19. If the amount is zero or less, stop here. Claiming your eitc is easy. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Be sure to check both state and federal eligibility requirements.

Earned Tax Credit Worksheet 2023

Enter your california earned income from form ftb 3514, line 19. Claiming your eitc is easy. Be sure to check both state and federal eligibility requirements. Enter your california earned income from form ftb 3514, line 19. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6.

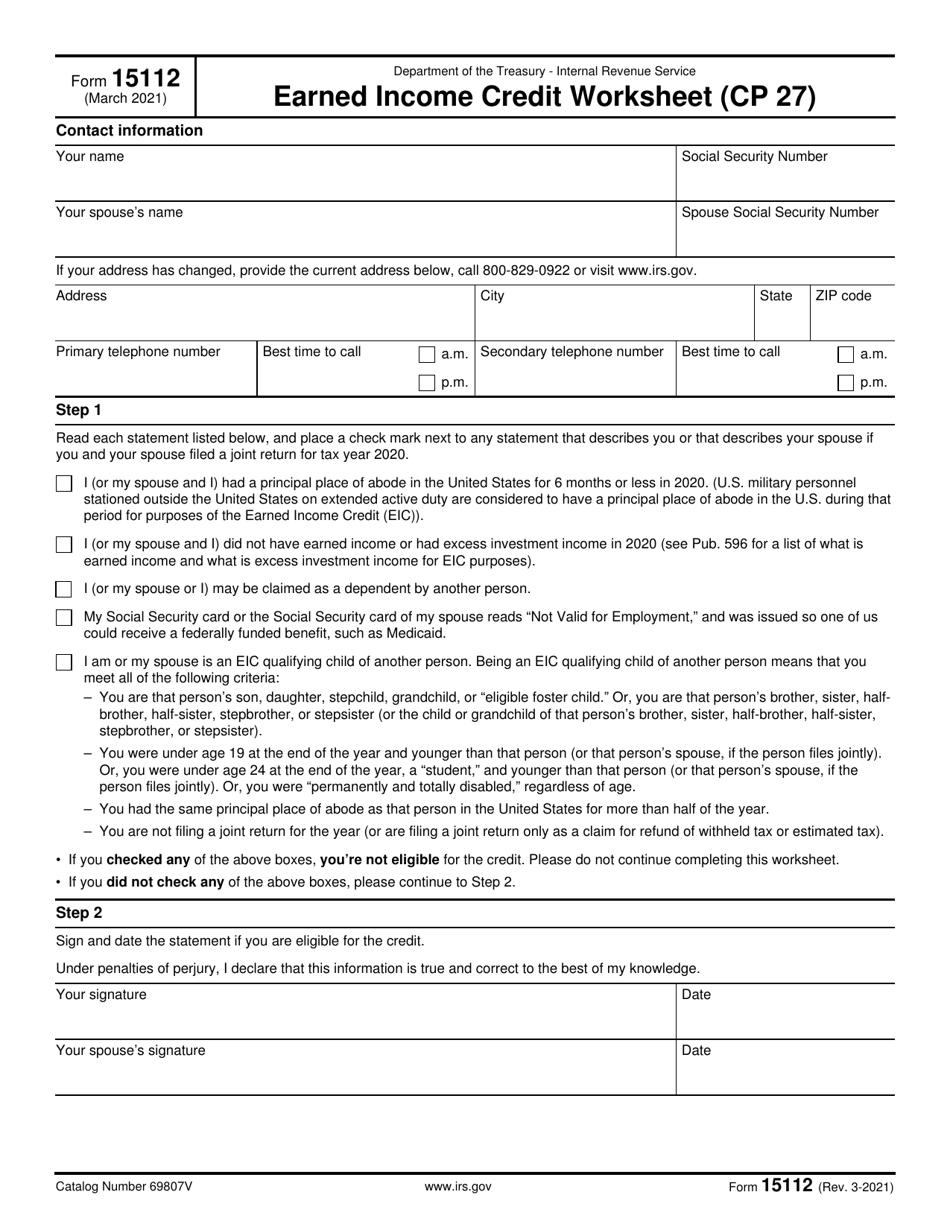

Earned Credit Worksheet Cp 27

Be sure to check both state and federal eligibility requirements. Look up the amount on line. Tax form for earned income tax credits. If the amount is zero or less, stop here. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6.

Earned Worksheet 2022 Worksheet Irs 1040 Form Tax Cre

Be sure to check both state and federal eligibility requirements. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Look up the amount on line. Claiming your eitc is easy. Tax form for earned income tax credits.

Form FTB3514 Download Fillable PDF or Fill Online California Earned

Enter your california earned income from form ftb 3514, line 19. If the amount is zero or less, stop here. Be sure to check both state and federal eligibility requirements. Look up the amount on line. Enter your california earned income from form ftb 3514, line 19.

Ca Earned Tax Credit Worksheet 2020

If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Complete the california earned income tax credit worksheet below. If the amount is zero or less, stop here. Claiming your eitc is easy. Be sure to check both state and federal eligibility requirements.

If The Amount Is Zero Or Less, Stop Here.

Look up the amount on line. Enter your california earned income from form ftb 3514, line 19. Tax form for earned income tax credits. Enter your california earned income from form ftb 3514, line 19.

You Must Fill Out Your Child/Children's Qualifying Information Along With Your Earned Income To Obtain The.

Be sure to check both state and federal eligibility requirements. Complete the california earned income tax credit worksheet below. Just file your state and/ or federal tax returns. Claiming your eitc is easy.

Compare The Amounts On Line 5 And Line 2, Enter The Smaller Amount On Line 6.

If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to.