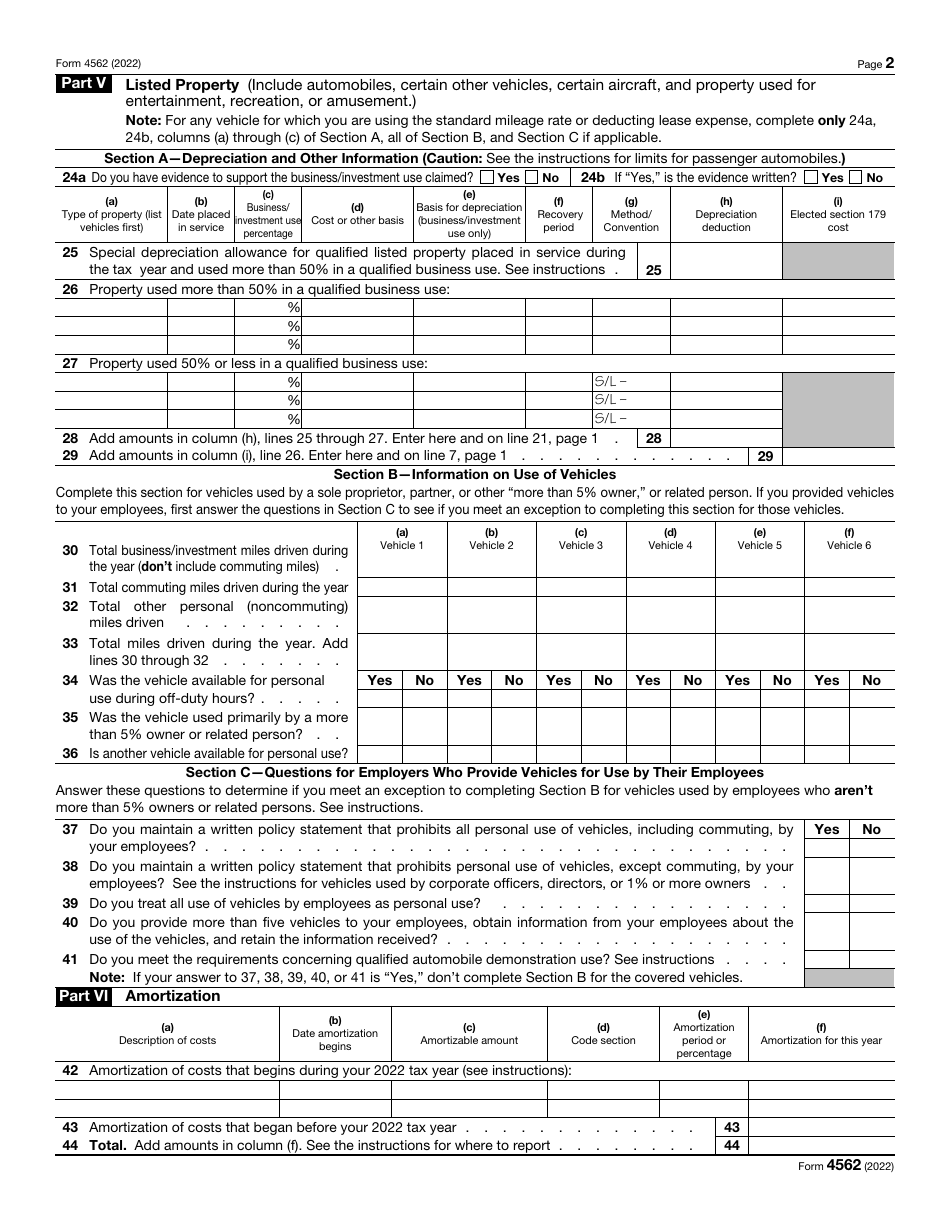

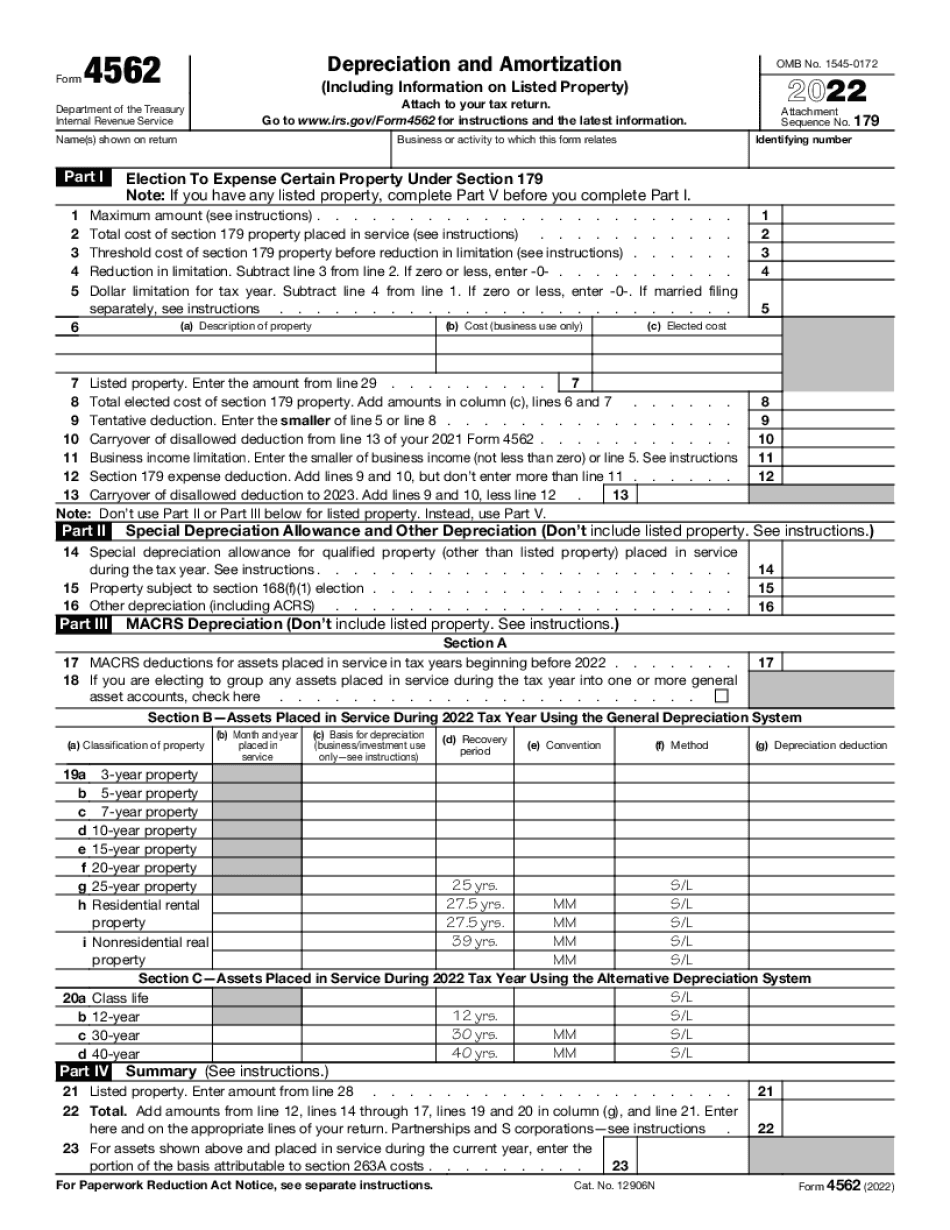

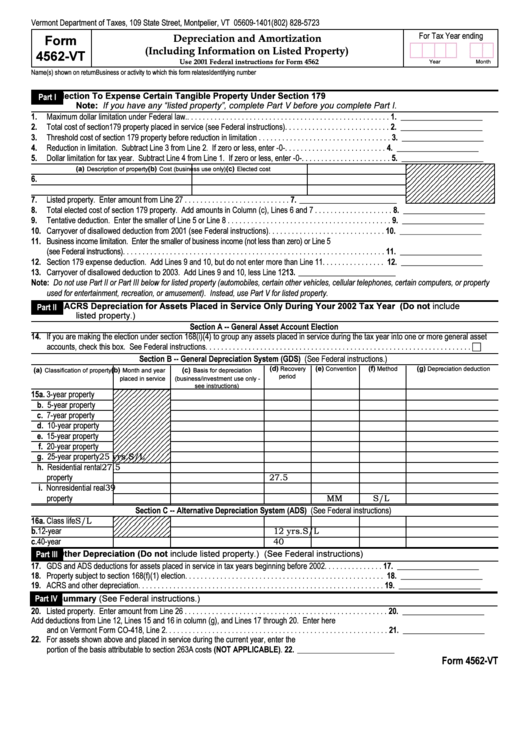

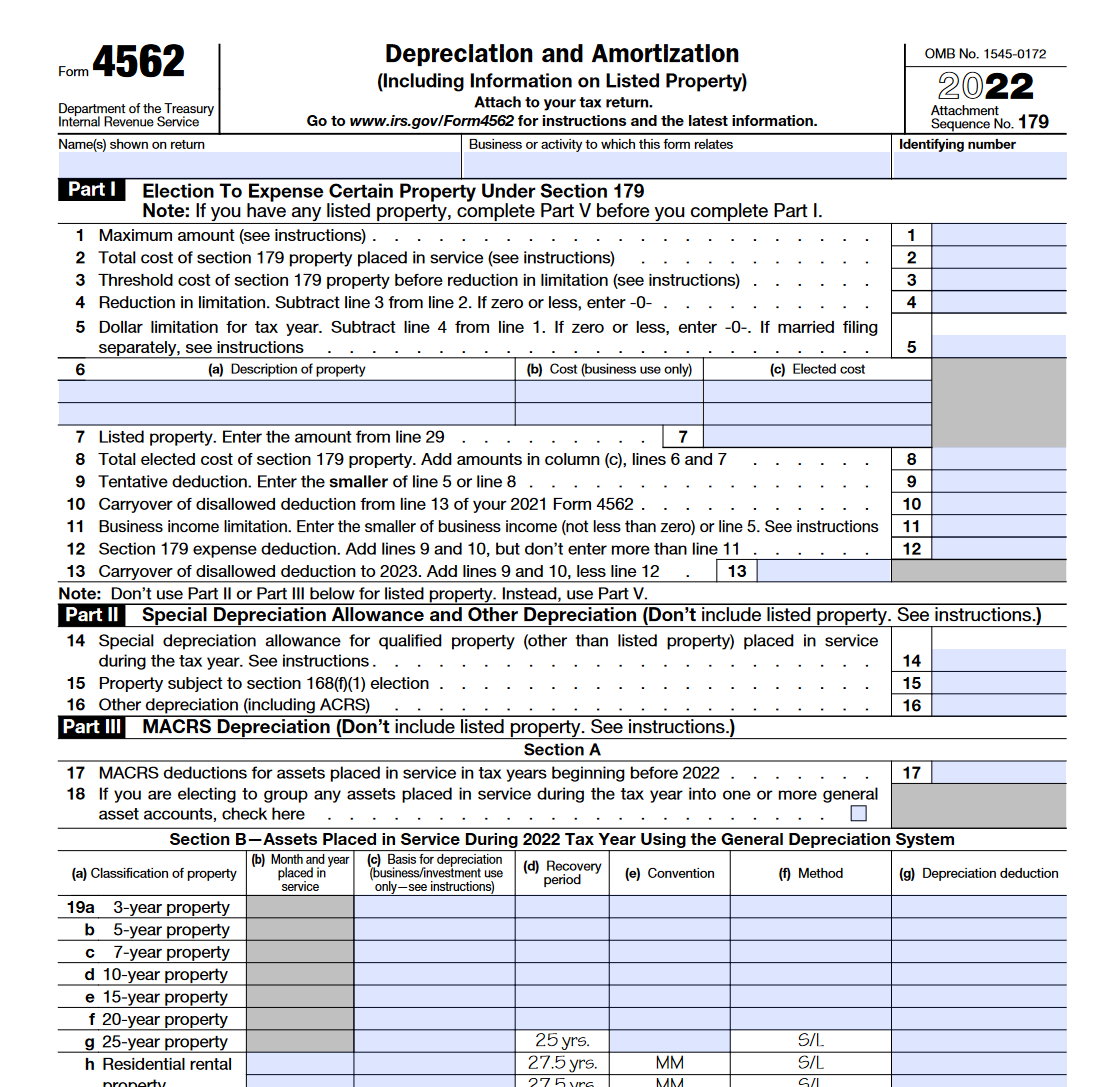

Form 4562 Depreciation And Amortization Worksheet - Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year. Claim your deduction for depreciation and amortization.

Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year. Claim your deduction for depreciation and amortization.

Special depreciation allowance for qualified listed property placed in service during the tax year. Irs form 4562 is a key document for businesses and individuals managing. Claim your deduction for depreciation and amortization.

Instructions for Form 4562 (2024) Internal Revenue Service

Claim your deduction for depreciation and amortization. Special depreciation allowance for qualified listed property placed in service during the tax year. Irs form 4562 is a key document for businesses and individuals managing.

IRS Form 4562 Instructions Depreciation & Amortization

Claim your deduction for depreciation and amortization. Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year.

Form 4562 Depreciation And Amortization Worksheet

Special depreciation allowance for qualified listed property placed in service during the tax year. Claim your deduction for depreciation and amortization. Irs form 4562 is a key document for businesses and individuals managing.

Form 4562 Depreciation And Amortization Worksheet

Claim your deduction for depreciation and amortization. Special depreciation allowance for qualified listed property placed in service during the tax year. Irs form 4562 is a key document for businesses and individuals managing.

Irs Form 4562 Depreciation Worksheet Worksheets For Kindergarten

Claim your deduction for depreciation and amortization. Special depreciation allowance for qualified listed property placed in service during the tax year. Irs form 4562 is a key document for businesses and individuals managing.

IRS Form 4562 Download Fillable PDF or Fill Online Depreciation and

Claim your deduction for depreciation and amortization. Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year.

Form 4562 depreciation and amortization worksheet Fill online

Claim your deduction for depreciation and amortization. Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year.

Form 4562 Depreciation And Amortization Worksheet

Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year. Claim your deduction for depreciation and amortization.

IRS Form 4562. Depreciation and Amortization Forms Docs 2023

Irs form 4562 is a key document for businesses and individuals managing. Claim your deduction for depreciation and amortization. Special depreciation allowance for qualified listed property placed in service during the tax year.

Claim Your Deduction For Depreciation And Amortization.

Irs form 4562 is a key document for businesses and individuals managing. Special depreciation allowance for qualified listed property placed in service during the tax year.