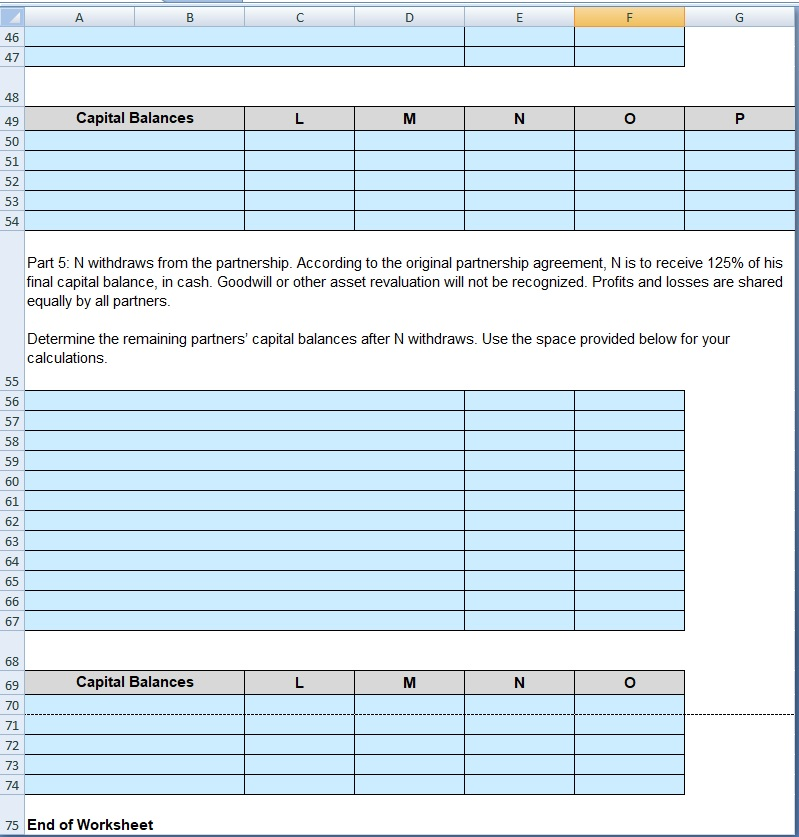

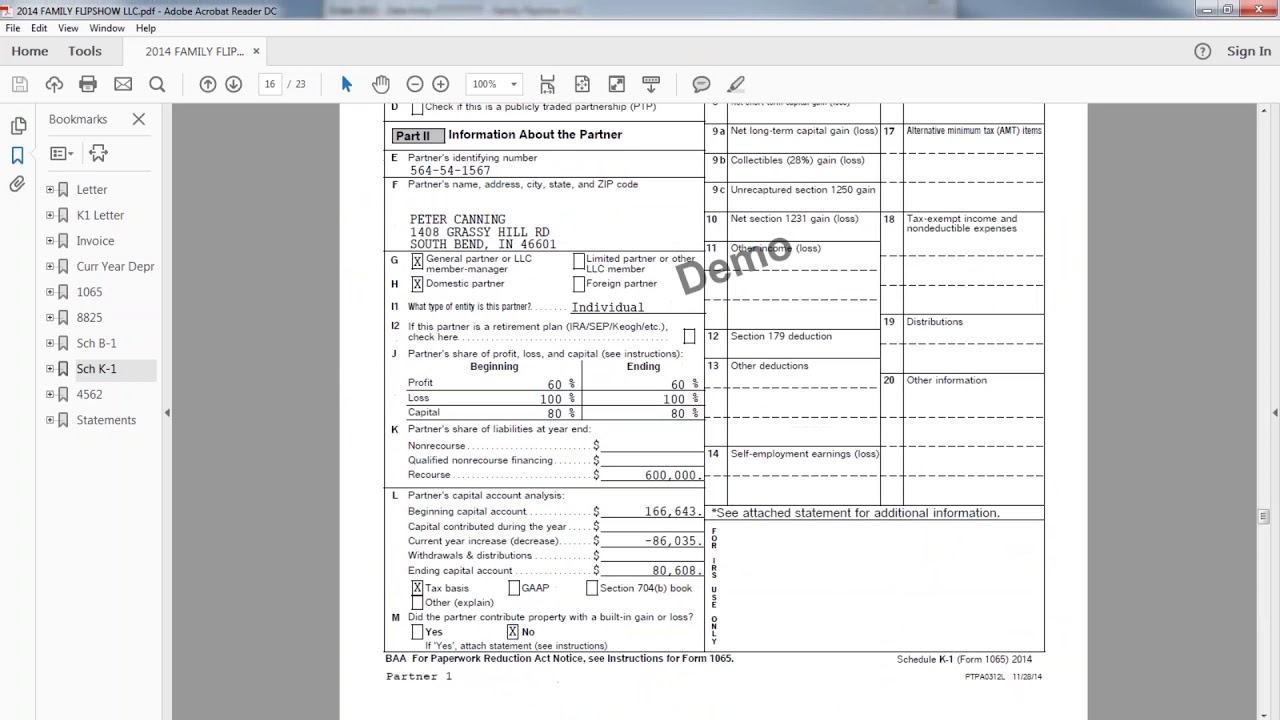

Partner Basis Worksheet - The adjusted partnership basis will be used to figure your gain or loss on the sale or. Use the basis wks screen to calculate a partner’s new basis after increases. The worksheet for adjusting the basis of a partner’s interest in the partnership. **pa law requires a partnership to depreciate property by a minimum amount it determines. To assist the partners in determining their basis in the partnership, a worksheet for. Learn about the tax rules and reporting requirements for partnerships and partners.

Learn about the tax rules and reporting requirements for partnerships and partners. **pa law requires a partnership to depreciate property by a minimum amount it determines. To assist the partners in determining their basis in the partnership, a worksheet for. Use the basis wks screen to calculate a partner’s new basis after increases. The adjusted partnership basis will be used to figure your gain or loss on the sale or. The worksheet for adjusting the basis of a partner’s interest in the partnership.

The adjusted partnership basis will be used to figure your gain or loss on the sale or. To assist the partners in determining their basis in the partnership, a worksheet for. **pa law requires a partnership to depreciate property by a minimum amount it determines. Use the basis wks screen to calculate a partner’s new basis after increases. Learn about the tax rules and reporting requirements for partnerships and partners. The worksheet for adjusting the basis of a partner’s interest in the partnership.

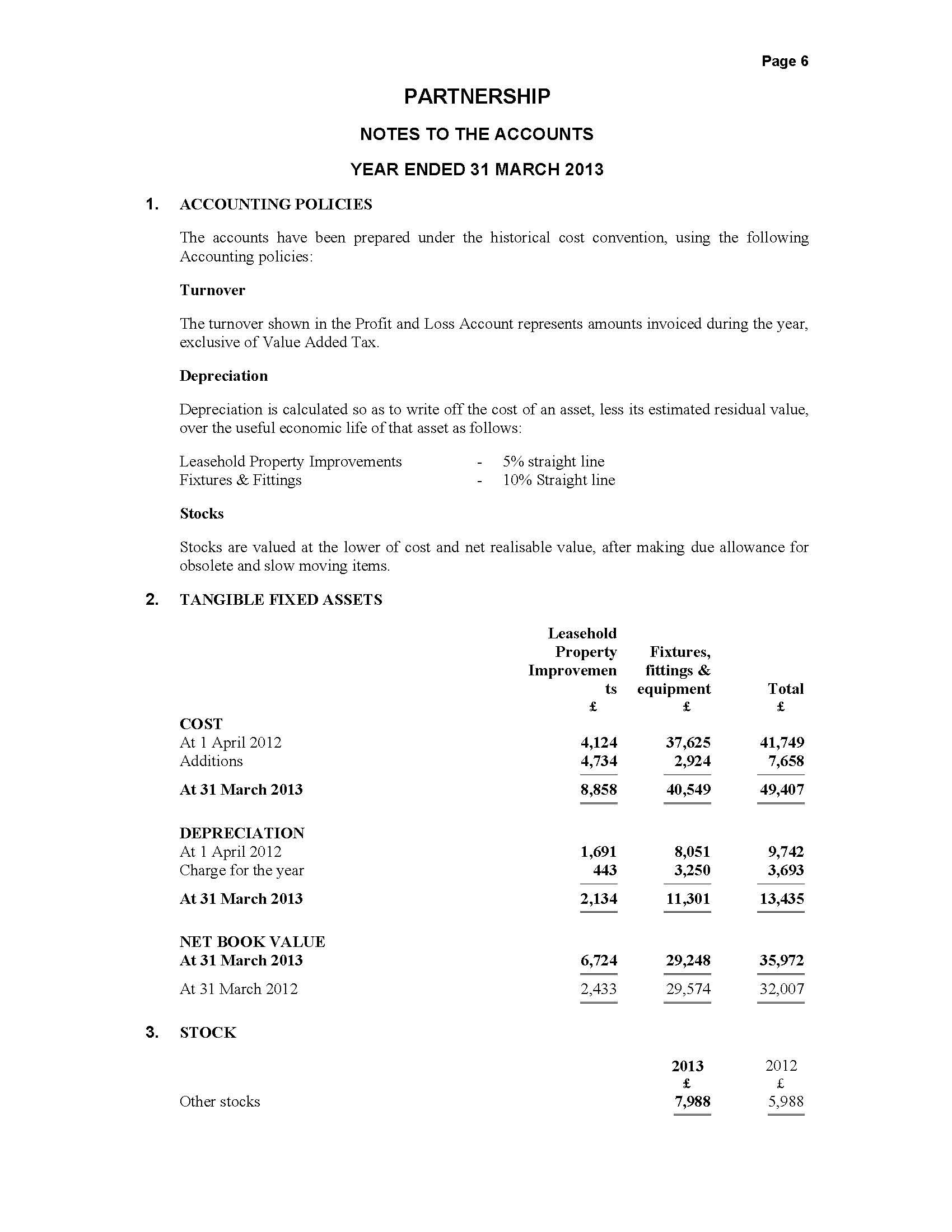

Partners Adjusted Basis Worksheet Public Finance Economy Of The

To assist the partners in determining their basis in the partnership, a worksheet for. The worksheet for adjusting the basis of a partner’s interest in the partnership. Use the basis wks screen to calculate a partner’s new basis after increases. Learn about the tax rules and reporting requirements for partnerships and partners. **pa law requires a partnership to depreciate property.

Partnership Basis Worksheet Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or. **pa law requires a partnership to depreciate property by a minimum amount it determines. The worksheet for adjusting the basis of a partner’s interest in the partnership. To assist the partners in determining their basis in the partnership, a worksheet for. Learn about.

Partner's Basis Worksheets

The worksheet for adjusting the basis of a partner’s interest in the partnership. The adjusted partnership basis will be used to figure your gain or loss on the sale or. Learn about the tax rules and reporting requirements for partnerships and partners. To assist the partners in determining their basis in the partnership, a worksheet for. Use the basis wks.

Form 1040 Partner's Basis Worksheet

The adjusted partnership basis will be used to figure your gain or loss on the sale or. **pa law requires a partnership to depreciate property by a minimum amount it determines. The worksheet for adjusting the basis of a partner’s interest in the partnership. Learn about the tax rules and reporting requirements for partnerships and partners. Use the basis wks.

Partnership Basis Calculation Worksheet Printable And Enjoyable Learning

To assist the partners in determining their basis in the partnership, a worksheet for. The worksheet for adjusting the basis of a partner’s interest in the partnership. The adjusted partnership basis will be used to figure your gain or loss on the sale or. **pa law requires a partnership to depreciate property by a minimum amount it determines. Use the.

Partner's Basis Worksheets

Use the basis wks screen to calculate a partner’s new basis after increases. The adjusted partnership basis will be used to figure your gain or loss on the sale or. To assist the partners in determining their basis in the partnership, a worksheet for. **pa law requires a partnership to depreciate property by a minimum amount it determines. The worksheet.

Partnership Adjusted Basis Worksheet Fillable

The adjusted partnership basis will be used to figure your gain or loss on the sale or. **pa law requires a partnership to depreciate property by a minimum amount it determines. Use the basis wks screen to calculate a partner’s new basis after increases. The worksheet for adjusting the basis of a partner’s interest in the partnership. Learn about the.

Partnership Basis Calculation Worksheets

**pa law requires a partnership to depreciate property by a minimum amount it determines. The worksheet for adjusting the basis of a partner’s interest in the partnership. The adjusted partnership basis will be used to figure your gain or loss on the sale or. To assist the partners in determining their basis in the partnership, a worksheet for. Use the.

Partner's Adjusted Basis Worksheets

**pa law requires a partnership to depreciate property by a minimum amount it determines. To assist the partners in determining their basis in the partnership, a worksheet for. Learn about the tax rules and reporting requirements for partnerships and partners. The worksheet for adjusting the basis of a partner’s interest in the partnership. Use the basis wks screen to calculate.

Irs Partnership Basis Calculation Worksheet

To assist the partners in determining their basis in the partnership, a worksheet for. Learn about the tax rules and reporting requirements for partnerships and partners. The worksheet for adjusting the basis of a partner’s interest in the partnership. Use the basis wks screen to calculate a partner’s new basis after increases. **pa law requires a partnership to depreciate property.

**Pa Law Requires A Partnership To Depreciate Property By A Minimum Amount It Determines.

The adjusted partnership basis will be used to figure your gain or loss on the sale or. To assist the partners in determining their basis in the partnership, a worksheet for. Use the basis wks screen to calculate a partner’s new basis after increases. Learn about the tax rules and reporting requirements for partnerships and partners.