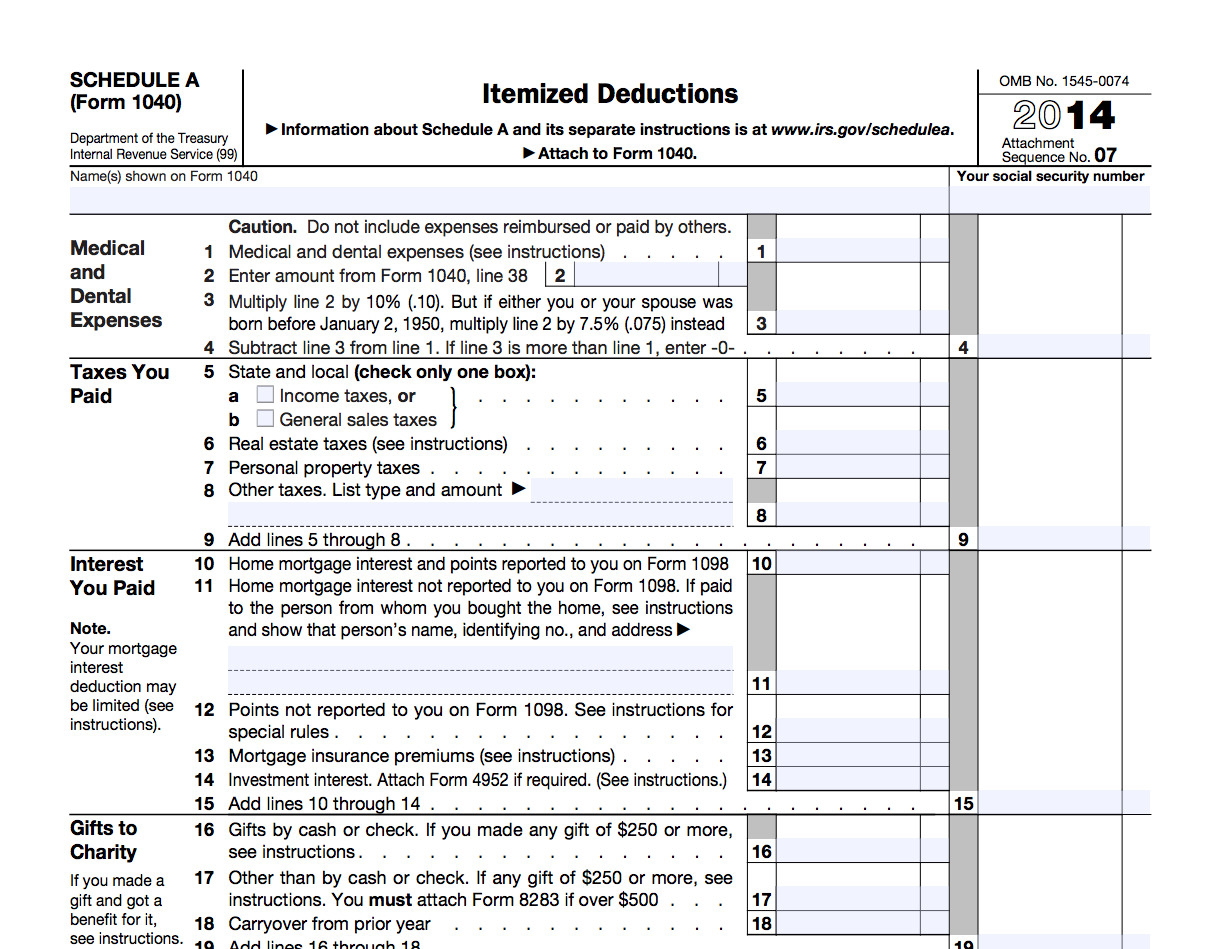

Printable Itemized Deductions Worksheet - In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the larger of your itemized. Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions.

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the larger of your itemized. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):.

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the larger of your itemized. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the.

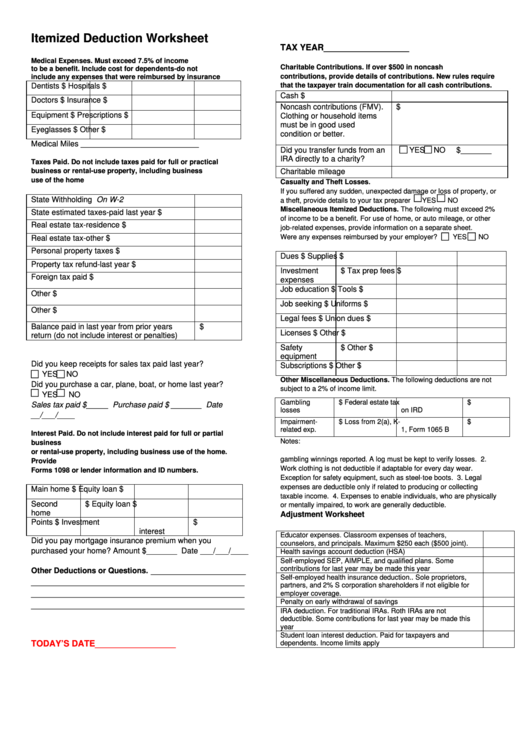

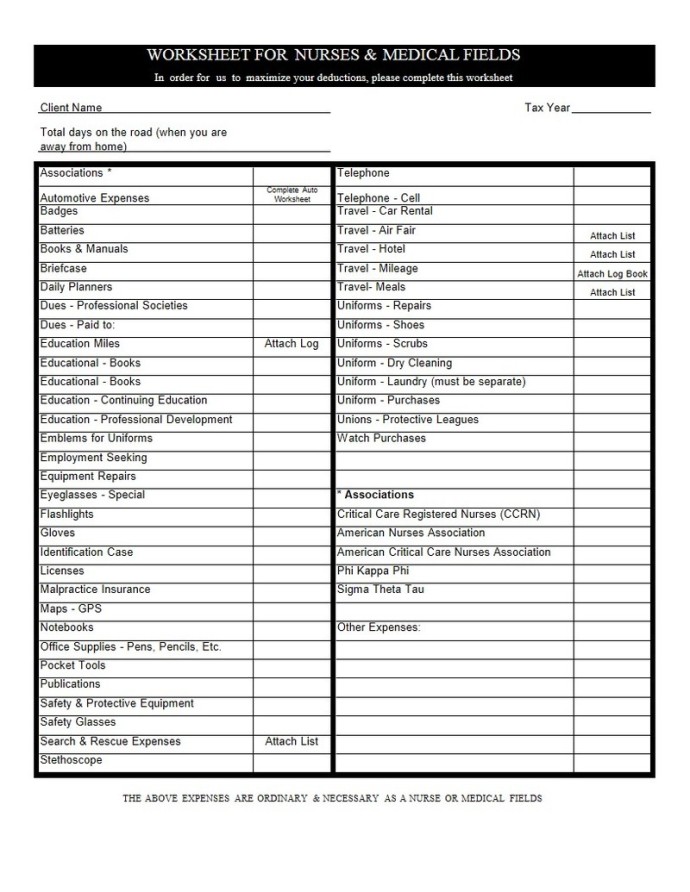

Itemized Deduction Worksheet printable pdf download

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the. We’ll use your 2022 federal standard.

Printable Itemized Deductions Worksheet

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most.

Printable Itemized Deductions Worksheet

In most cases, your federal income tax will be less if you take the. In most cases, your federal income tax will be less if you take the larger of your itemized. Use schedule a (form 1040) to figure your itemized deductions. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. If you.

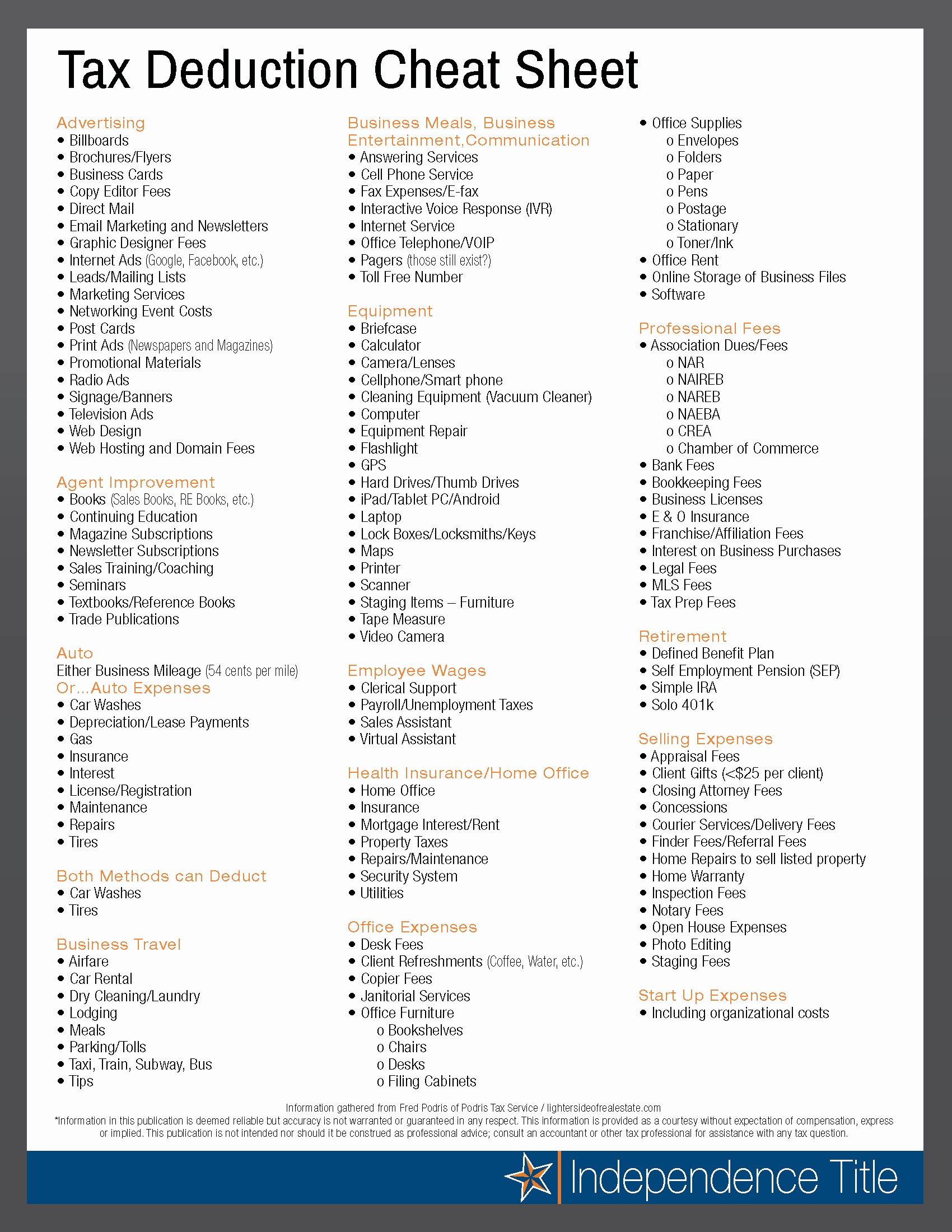

A List Of Itemized Deductions

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard.

Tax Itemized Deductions Worksheet

Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the larger of your itemized. If you elect to itemize deductions even though.

Itemized Deductions Worksheets

In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Download these income tax.

Printable Itemized Deductions Worksheet

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Use schedule a (form 1040) to figure your itemized deductions. In most cases, your federal income tax will.

Printable Itemized Deductions Worksheet

If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than.

Itemized Deductions Worksheet —

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. Download these income tax worksheets and organizers to maximize your deductions and.

Printable Itemized Deductions Worksheet

If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. Download these income tax.

If You Elect To Itemize Deductions Even Though They Are Less Than Your Standard Deduction, Check This Box.

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):.

In Most Cases, Your Federal Income Tax Will Be Less If You Take The.

In most cases, your federal income tax will be less if you take the larger of your itemized.