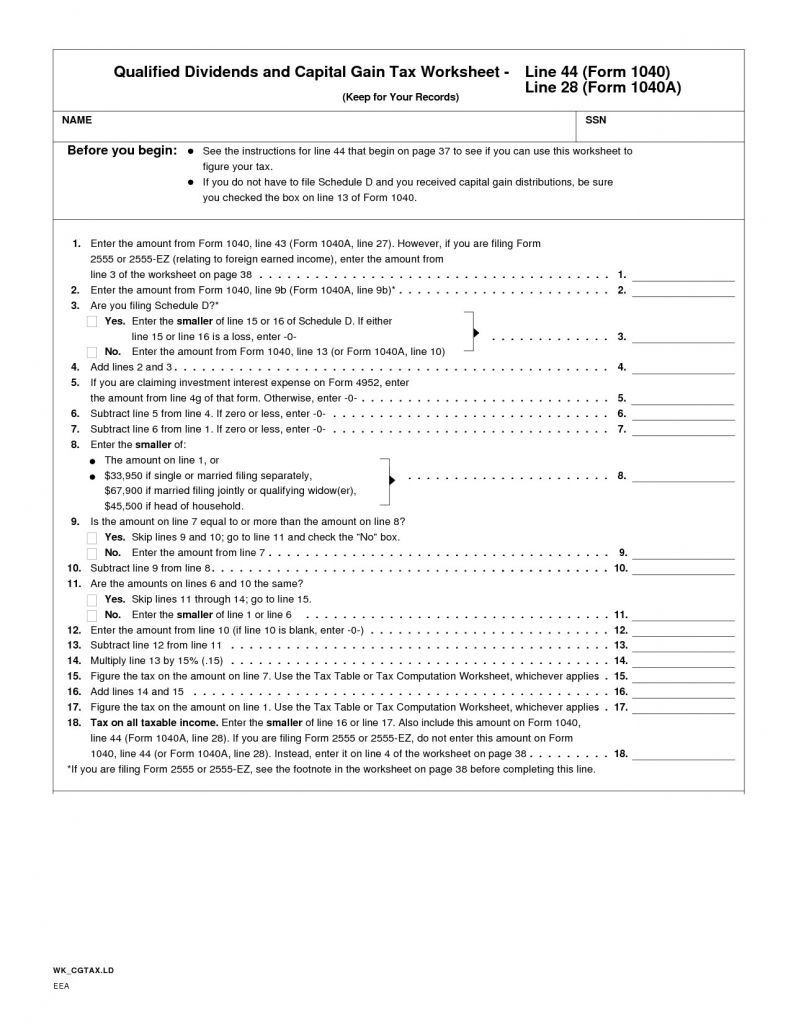

Qualified Dividends Tax Worksheet - The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Dividends are generally taxed at your ordinary income tax rates.

The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. This worksheet helps you calculate the tax on qualified dividends and capital gains that you.

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Dividends are generally taxed at your ordinary income tax rates.

1040 Qualified Dividends And Capital Gain Tax Worksheet Prin

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Complete this worksheet only if line 18.

Qualified Dividends And Capital Gains Tax Worksheet Qualifie

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. The qualified.

Qualified Dividends And Capital Gain Tax Worksheet Instructi

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Did you dispose of any investment(s) in a qualified opportunity fund during.

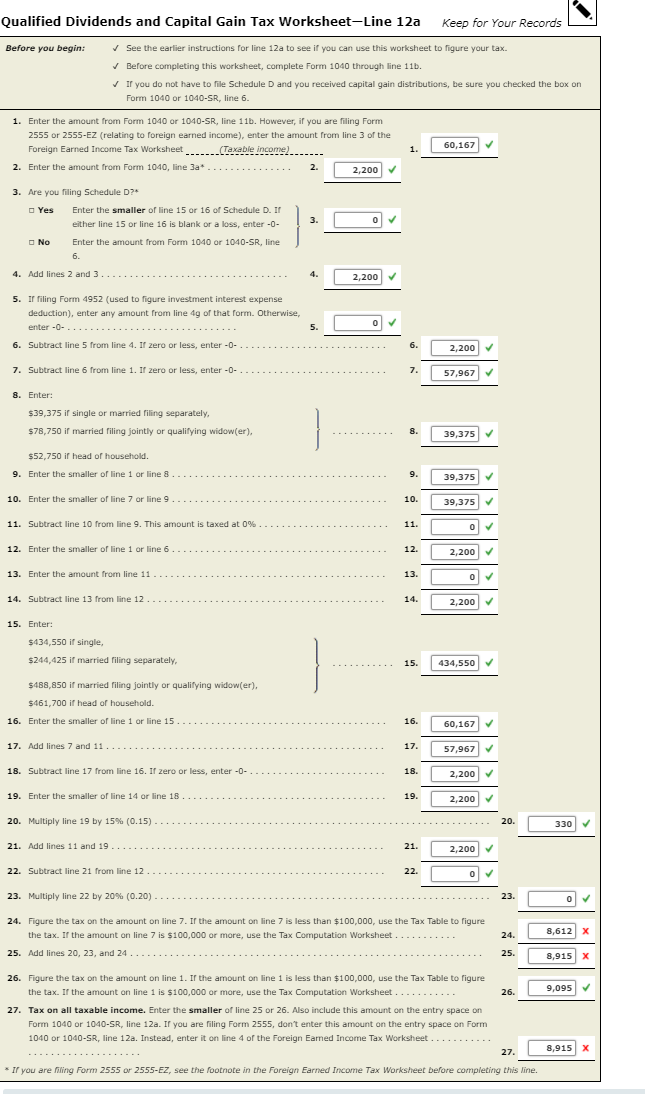

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The qualified.

2023 Qualified Dividends And Capital Gain Tax Worksheet Gain

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or.

Dividend And Capital Gain Worksheet 2021

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. The qualified dividends and capital gain worksheet is vital for taxpayers.

Qualified Dividends And Capital Gain Tax Worksheet 2023

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Dividends are generally taxed at your ordinary income tax rates. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. The qualified.

Qualified Dividends And Capital Gains Tax Worksheet 2023 Qua

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15..

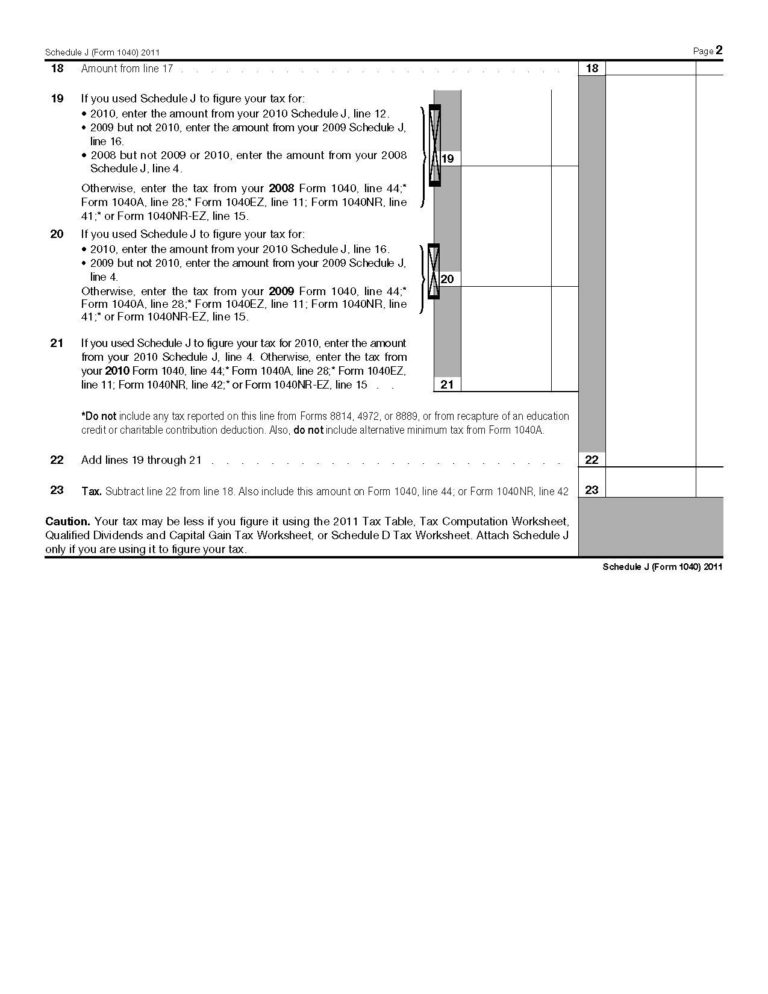

Qualified Dividends And Capital Gain Tax Worksheet 2021

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates. The qualified dividend and capital gain tax.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Dividends are generally taxed at your ordinary income tax rates. The qualified.

The Qualified Dividends And Capital Gain Worksheet Is Vital For Taxpayers Aiming To.

Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15.