Tax And Interest Deduction Worksheet - Medical and dental expenses are deductible only to the extent they exceed 7.5%. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Enter amount from form 1098, box 1 (and box 2, if applicable).

Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed 7.5%. In most cases, your federal income tax will be less if you take the.

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter amount from form 1098, box 1 (and box 2, if applicable). Import prior year's datafile investment taxes

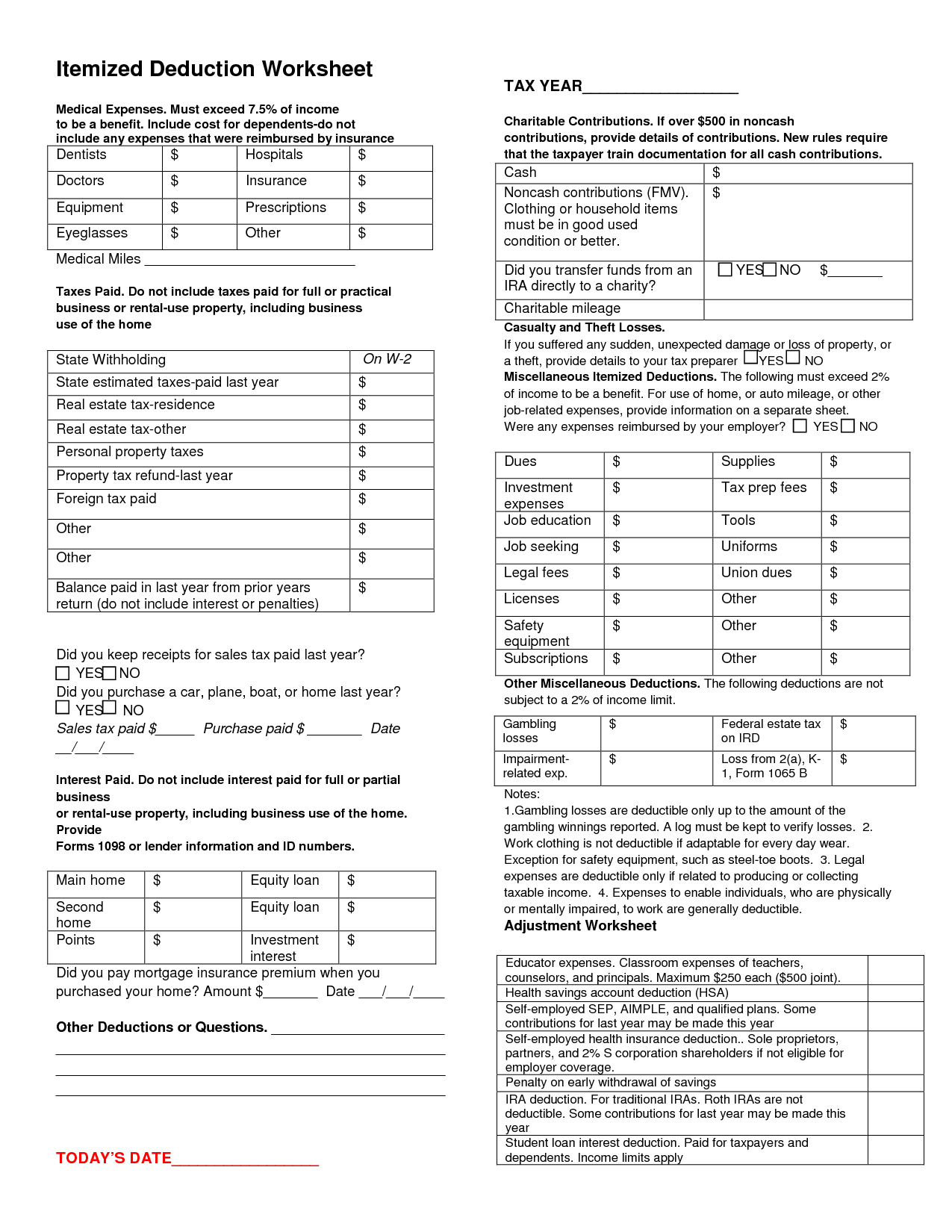

Tax Itemized Deductions Worksheet

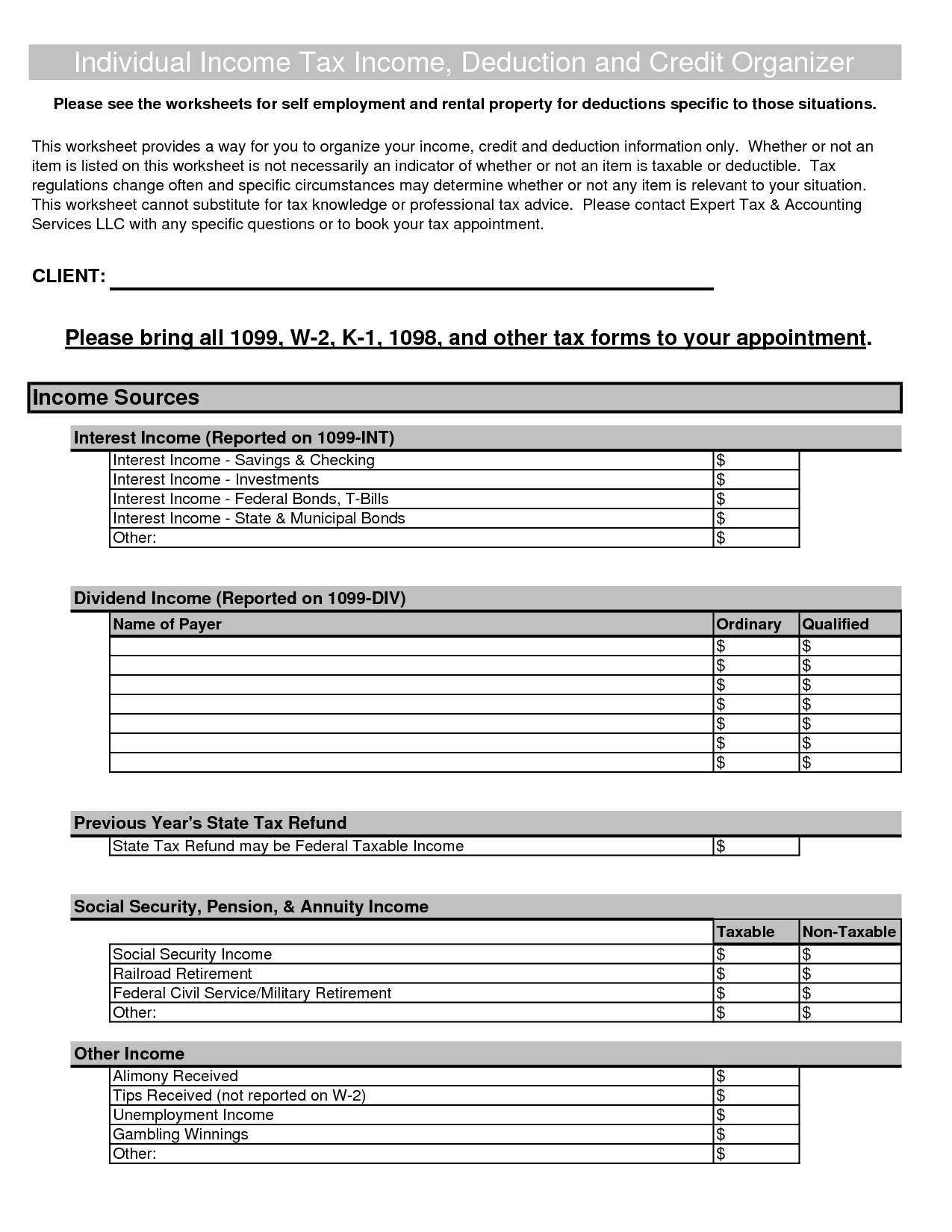

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Medical and dental expenses are deductible only to the extent they exceed 7.5%. The tax and interest deduction worksheet helps taxpayers compute eligible deductions,.

18 Itemized Deductions Worksheet Printable /

Enter amount from form 1098, box 1 (and box 2, if applicable). The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Import prior year's datafile investment taxes Medical and dental expenses are deductible only to the extent they exceed 7.5%. Download these income tax worksheets and organizers to maximize your deductions and minimize errors.

FREE Home Office Deduction Worksheet (Excel) For Taxes Worksheets Library

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter amount from form 1098, box 1 (and box.

Tax And Interest Deduction Worksheet Line 1b

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental.

Tax And Interest Deduction Worksheets

Medical and dental expenses are deductible only to the extent they exceed 7.5%. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Enter amount from form 1098, box 1 (and box 2, if.

Tax And Interest Deduction Worksheets

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Enter amount from form 1098, box 1 (and box.

Tax And Interest Deduction Worksheet Worksheets Library

In most cases, your federal income tax will be less if you take the. Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed 7.5%. Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax.

Tax And Interest Deduction Worksheet Worksheets, Online taxes, Deduction

In most cases, your federal income tax will be less if you take the. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Import prior year's datafile investment taxes Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter amount from form 1098, box 1 (and box 2, if applicable).

Tax Deduction Worksheets

Medical and dental expenses are deductible only to the extent they exceed 7.5%. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. In most cases, your federal income tax will be less if you take the. Enter amount from form 1098, box 1 (and box 2, if applicable). Import prior year's datafile investment taxes

Tax And Interest Deduction Worksheet Turbotax Worksheets Library

In most cases, your federal income tax will be less if you take the. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter amount.

Enter Amount From Form 1098, Box 1 (And Box 2, If Applicable).

Import prior year's datafile investment taxes Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Medical and dental expenses are deductible only to the extent they exceed 7.5%.